Pillar 2: Strategic considerations for implementation

Understand Pillar 2: Global Minimum Tax and its business impact

International tax is undergoing a fundamental transformation, and Pillar 2 is at the heart of it. While the concept of a global minimum tax rate of 15% is simple in theory, its implementation is highly complex, with significant variation in how individual countries adopt the OECD framework. This single-session virtual training is designed to help senior finance and tax leaders cut through the complexity, understand the key elements of Pillar 2 and assess its potential impact on their business operations and tax strategy.

£495

*excl VAT for UK courses

Learning objectives

At the end of this course, participants will be able to:

- Explain the broad reporting requirements for Pillar 2 implementation

- Identify what information will be required for Pillar 2 implementation

- Identify key risk areas for Pillar 2 implementation

- Identify potential changes to structures and costing methodologies that may need to be implemented as a result of additional tax costs

- Evaluate the impact on budgeting and forecasting processes in their business

- Determine the practical staffing requirements in their business.

What's included?

- Group internet-based instruction led by experienced tax professionals using practical examples to explain key concepts

- Focused exploration of common challenges and grey areas in the implementation of Pillar 2

- Interactive discussions and Q&A to encourage participation and connect the material to participants’ business contexts.

Who should attend?

This course is aimed at senior management who are concerned about the practical implementation of Pillar 2 across their organisation, not just the financial staff.

What can I expect?

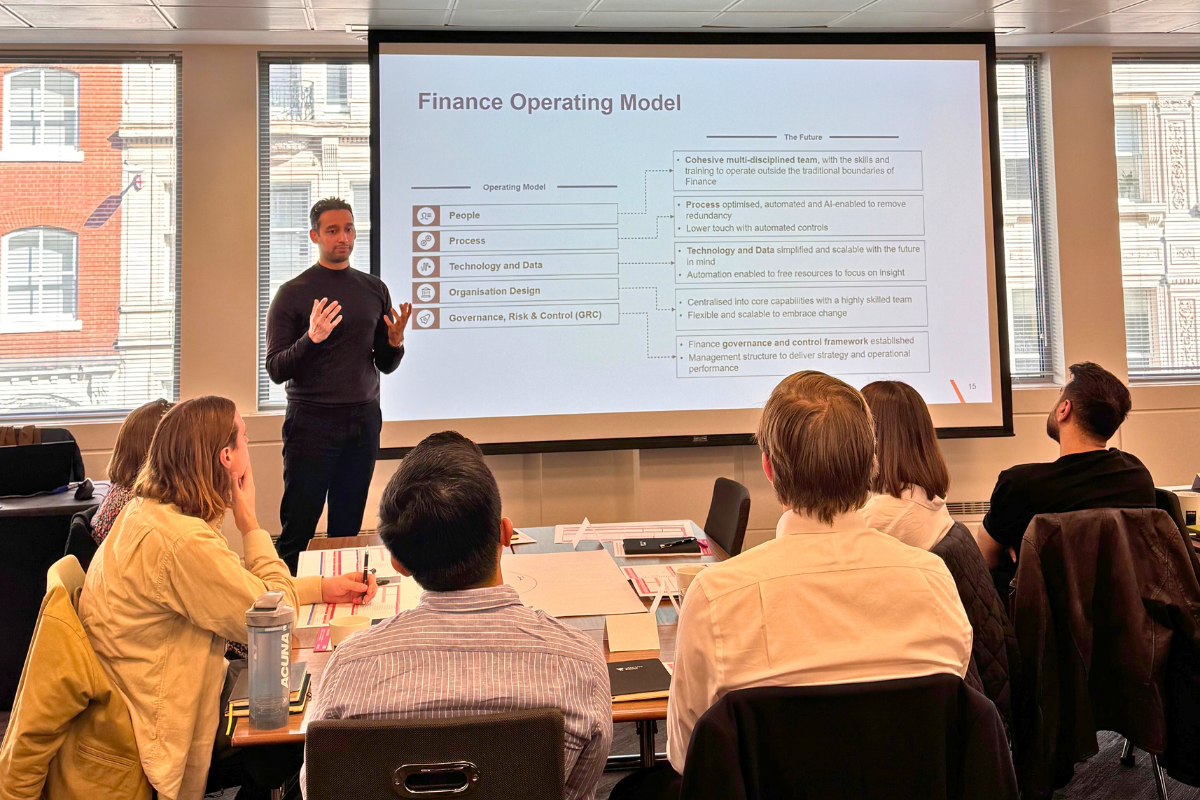

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

- Well-equipped classrooms - all our courses take place in well-located, great quality hotels or event spaces with excellent facilities

- Our virtual courses take place via Zoom

- Your very own VantagePoint welcome pack.

Your Pillar 2 course in detail

In-depth information about the course

There certainly has been a huge amount of hype regarding the implementation of a global minimum tax rate. Proponents of the tax argue that it will promote healthy competition, as countries now have to provide services rather than just tax savings to attract business. Detractors argue that it interferes with the sovereign power of governments and will increase costs. However, what is certain is that it is here to stay, with over 100 countries signing on to the implementation process.

The aim of this course is not to look at the merits of such a global minimum tax but rather to focus on the strategic and operational risks to businesses that will be created. To do this, a refresher of the key requirements of Pillar 2, as envisaged by the OECD, will be covered.

Once that groundwork is laid, then we examine some key issues that would need to be considered, such as:

- What information is required from your data system?

- Do you have adequately trained/sufficient staff to produce the required reports?

- How up-to-date is your understanding of the various legal entities in your group?

- Can you identify the income streams and taxes paid by country?

- Do all our organisational structures still make sense in light of this change?

At the end of this session, it is hoped that you will have a clearer understanding of how Pillar 2 will impact your business and a list of key issues to be resolved.

Review of key Pillar 2 concepts

Practical implementation considerations relating to:

- Strategy

- Costing methodology

- Reporting structures

- Staffing

This course is delivered through live, internet-based instruction combining expert guidance with practical insights to support clear understanding and real-world application.

- Group internet-based instruction led by experienced tax professionals using practical examples to explain key concepts

- Focused exploration of common challenges and grey areas in the implementation of Pillar 2

- Interactive discussions and Q&A to encourage participation and connect the material to participants’ business contexts

- In line with VantagePoint’s sustainability commitment, course materials are provided in digital format. Printed handouts will be limited to in-class exercises only.

This course provides four hours of CPE/CPD credits.

VantagePoint Training is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org. For information regarding administrative policies such as our complaint policy and refund policy, please contact us at training@vantagepoint.consulting.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

.svg)