IFRS 9: Derivatives and hedge accounting

An intensive two-day course giving you a deep dive into the complex accounting and reporting of derivatives under IFRS 9

This course covers fair value, cash flow and net investment hedges, the transition from IAS 39, IFRS 7 disclosure requirements and the broader operational impact on systems, risk management and documentation. Designed for finance professionals, you'll gain practical insight to allow you to confidently navigate this highly technical area of financial reporting.

£1,950*

*excl VAT for UK courses

Learning objectives

At the end of this course, participants will be able to:

- Explain the reasons why companies hedge

- Construct a successful hedge and use hedge engineering to achieve better results

- Measure hedge effectiveness and ineffectiveness

- Identify and account for the following hedges: fair value hedges, cash flow hedges, net investment hedges and portfolio hedges of interest rate risk (macro hedges)

- Identify and analyse embedded derivatives

- Determine the appropriate treatment of embedded derivatives under IFRS 9

- Summarise the latest developments on the macro-hedging standard.

What's included?

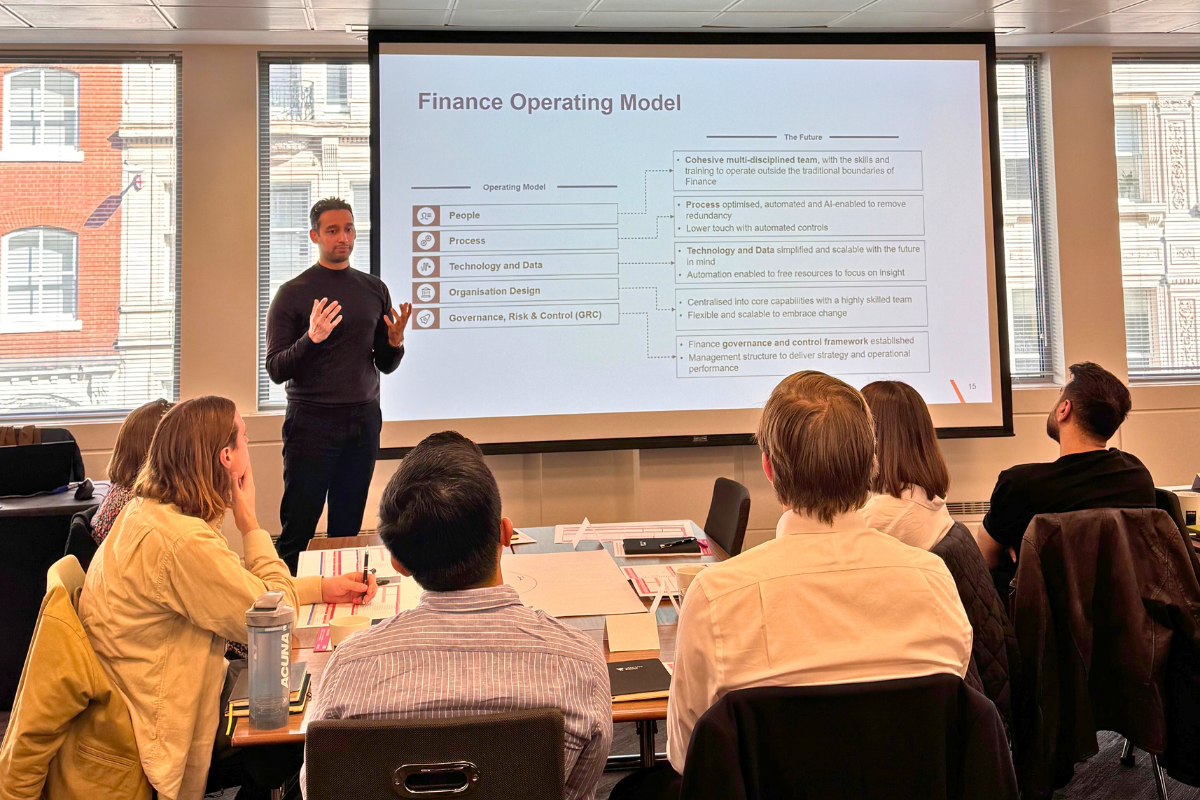

This course is delivered in an expert-led, interactive format designed to bring clarity to one of the most technical areas of IFRS:

- Group live instruction by IFRS specialists with deep experience in derivatives and hedge accounting

- Real-world case studies and examples illustrating fair value cash flow and net investment hedges in practice

- Step-by-step walkthroughs of hedge documentation, effectiveness testing and journal entries

- Interactive group discussions and Q&A to explore challenges and industry-specific applications

- Coverage of IFRS 7 disclosure requirements, with sample notes and illustrative financial statements

- In line with VantagePoint’s sustainability commitment, course materials are provided in digital format. Printed handouts will be limited to in-class exercises only and fully electronic course materials (including case studies, illustrations and examples) will be provided for you to keep.

- NASBA approved CPD/CPE credits.

Who should attend?

This course is primarily designed for those who use derivatives and hedge accounting under IFRS in their company or are considering doing so in the future:

- Accountants in an investment bank or treasury operation/internal audit in a bank

- Individuals working in non-banking entities or corporates where hedge accounting is applied or being considered for the first time

- Industry controllers, external auditors, analysts and other finance professionals who are interested in learning about derivatives and hedge accounting.

What can I expect?

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

- Well-equipped classrooms - all our courses take place in well-located, great quality hotels or event spaces with excellent facilities

- Your very own VantagePoint welcome pack.

Your IFRS 9 course in detail

In-depth information about the course

This comprehensive two-day course provides an in-depth review of the current IFRS accounting and reporting requirements for derivatives and hedging.

The use of derivatives and hedge accounting in IFRS 9 has a significant impact on the financial statements of financial and non-financial organisations, it is therefore important for organisations to understand the hedge accounting principles in IFRS 9. Though IFRS 9 has replaced IAS 39, organisations can elect to continue with IAS 39 hedge accounting until the IASB’s separate project on macro hedging is completed. Therefore, the course covers the key differences between IFRS 9 and IAS 39 hedge accounting.

This course explains the requirements for derivatives and hedging in clear, simple language using illustrations from corporate annual reports and other real-world examples, including popular hedging activities during rising/high interest rate environments and foreign exchange volatility. The specialist instructor provides explanations and illustrations on valuations, hedge documentation processes, effectiveness testing and journal entry.

This program answers questions such as:

- How does the classification of financial instruments affect the decision to use hedge accounting?

- What is fair value?

- What are the requirements for hedge accounting, including hedge documentation?

- How is hedge effectiveness designed and tested?

- How can hedge engineering work to achieve better results?

- How are embedded derivatives identified and accounted for?

- What are the quantitative and qualitative disclosure requirements for derivatives and hedge accounting in IFRS 9?

- What are the principal similarities and differences between US GAAP and IFRSs in the area of derivatives and hedge accounting?

- Classification and measurement

- Effective interest method

- Analysis and examples of common derivatives (including options, interest rate swaps, currency swaps, forwards and futures)

- Cash flows

- Variations of ‘standard’ derivative contracts

- Techniques for measuring fair values

- Accounting for derivatives

- Analysis and examples of embedded derivatives in debt host contracts, equity host contracts and purchase/sale contracts

- Accounting for embedded derivatives

- Determining how embedded derivatives affect the ‘cash flow characteristics’ test under IFRS 9

- Determining the separation conditions

- Allocating the initial carrying amount to embedded derivatives that are separated

- Analysis and examples of common hedging relationships

- Hedged items

- Hedging instruments

- Definition and mechanics of fair value, cash flow and net investment hedges

- Examples (commodity contracts, interest rate and foreign exchange risk exposures)

- Overview of the hedge accounting framework

- Alignment with risk management policies

- Hedge documentation

- Hedged items

- Hedging instruments

- Effectiveness assessment and rebalancing

- Recording hedge effectiveness

- Group and net positions

- Key differences from IAS 39 hedge accounting

- Discontinuation of hedge accounting

- Transitional issues and disclosures

- Update on macro hedge accounting standard.

- Group live instruction, cases, examples, group work and open discussions

- Descriptions and explanations of accounting principles

- Analysis and mechanics of common derivative products and hedging relationships

- Practical illustrations using model journal entries, model financial statement disclosures, case studies and real-world examples

- Analysis of IFRS 9 hedge accounting, including the key differences from IAS 39 and the impact of transition

- Interactive participation is encouraged

- At VantagePoint, we have a policy to avoid unnecessary printing. All course materials will be provided in soft copy. The only printed materials will be those necessary for exercises in class.

This course provides you with 16 hours of CPE/CPD credits.

VantagePoint Training is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org. For information regarding administrative policies such as our complaint policy and refund policy, please contact us.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

Bring this course in-house

Do you need to upskill your team? We specialise in the design and delivery of bespoke events for finance and sustainability teams.

Contact us to discuss your requirements - we'd love to hear how we can help.

The courses you need

Not seeing the ideal course? Our course schedule is driven by demand. If your chosen course is not scheduled, or there’s a topic, date or location you’d like to see,. please let us know.

Stay updated

To stay up to date with news on our latest courses, topics, webinars and free in person events sign up to our newsletter using the button below.

Bring this course in-house

The courses you need

Stay updated

VantagePoint Training attendee

HSS Hire - attendee

Chinonso Nwagbara

Five day course - attendee

VantagePoint Training attendee

CIIPA - attendee

"Very professional and efficient service - kept to allocated timings and audio/visual was very smooth."

VantagePoint Training attendee

EUMETSAT - attendee

Trusted by

.svg)