IFRS for the minerals and mining sector

IFRS training focused on the minerals and mining industries

This practical four-session virtual course is designed for accounting and finance professionals in the mining industry. It offers clear guidance on applying IFRS to key areas such as exploration costs, production stripping, impairment, joint arrangements, decommissioning and revenue recognition. Using real-world examples and industry-specific case studies, the course equips participants to navigate complex reporting requirements and produce high-quality financial statements that reflect mining operations.

£2,995*

*excl VAT for UK courses

Learning objectives

At the end of this course, participants will be able to:

- Apply the accounting and disclosure requirements of IFRS 6 exploration for and evaluation of mineral resources

- Explain the diversity in accounting practices in the extractive industry and the IASB’s project to review those practices

- Apply hedge accounting

- Recognise the relevant accounting guidance for the extractive industry under US and Canadian GAAP

- Discuss the options available for valuing tangible assets

- Interpret the complex rules on evaluating assets for impairment

- Complete a smooth transition to IFRS

- Explain the nature and structure of joint ventures in the minerals and mining industry

- Describe the external financial reporting requirements for joint ventures

- Explain the mechanisms of financing and reporting the operations of joint ventures

- Discuss the issues regarding intra-partner relationships, including cost allocation and audits

- Explain IFRS 11 joint arrangements and its impact on the accounting treatment of joint ventures and other joint arrangements

- Describe the rules of the interpretation IFRIC 20 “Stripping Costs in the Production Phase of a Surface Mine”.

Who should attend?

- CFOs new to the minerals and mining industry

- CFOs of mineral and mining companies in the process of adopting IFRS

- Financial and management accountants in the minerals and mining industry

- Internal and external auditors of minerals and mining companies reporting under IFRS

- Financial analysts seeking to improve their understanding of the accounting by minerals and mining companies.

What's included?

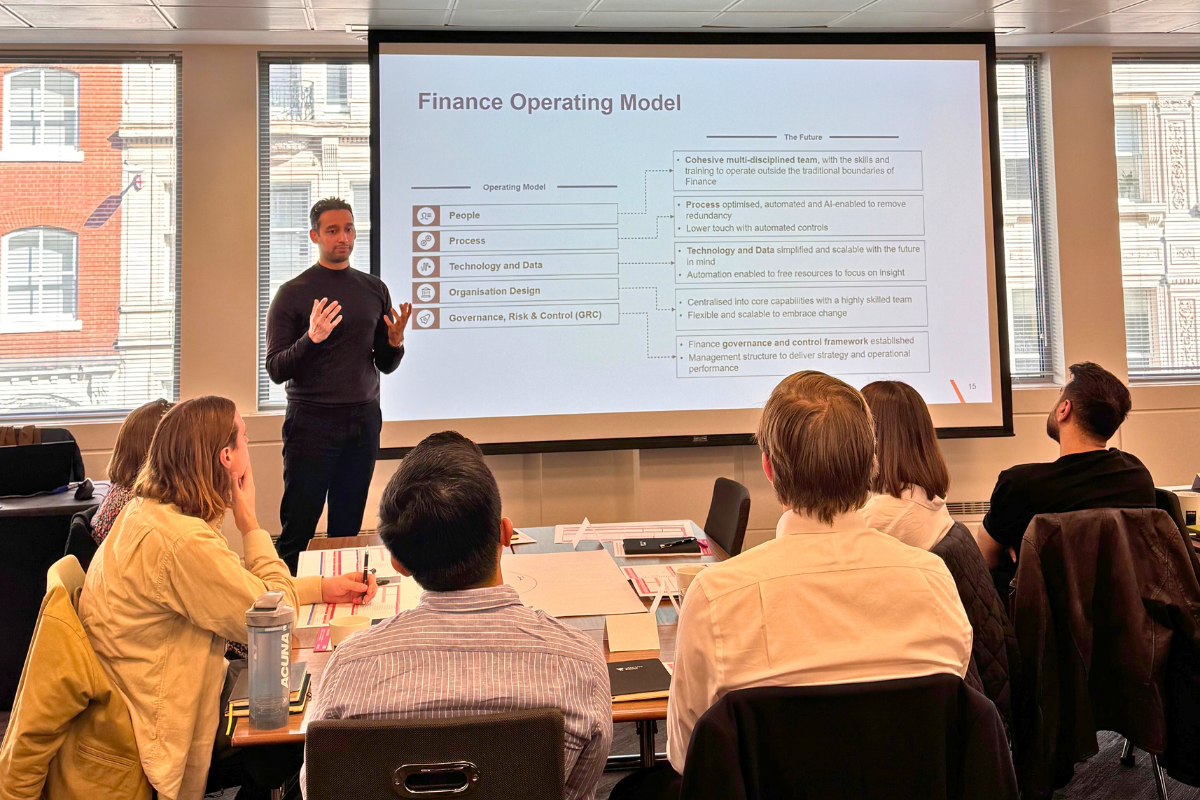

This course is delivered in an interactive workshop format - either in person or online, with a strong emphasis on real-world application.

- Group live or group internet-based instruction by expert facilitators tailored to the unique accounting issues faced in the mining sector

- Hands-on case studies and worked examples, allowing participants to apply IFRS concepts in context

- Facilitated group discussions and Q&A sessions that encourage knowledge sharing and exploration of practical challenges.

What can I expect?

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

- Well-equipped classrooms - all our courses take place in well-located, great quality hotels or event spaces with excellent facilities

- Your very own VantagePoint welcome pack.

Your IFRS for the minerals and mining sector course in detail

In-depth information about the course

There are diverse accounting practices among companies in the worldwide extractive industry. The IASB has commissioned a research project to review accounting practices for extractive activities.

To provide some guidance and a transition for entities in the extractive industry that are adopting IFRS, the IASB issued IFRS 6 Exploration for and Evaluation of Mineral Resources in December 2004. The standard applies to expenditures incurred in connection with the exploration and evaluation of mineral resources.

This course summarises the accounting and disclosure requirements of IFRS 6 and discusses the current status of the IASB’s work on accounting for extractive activities. Key accounting standards that affect the industry are also given in-depth coverage, such as IFRS rules on the impairment of assets, recognition and measurement of assets, revaluations of certain qualifying assets, decommissioning and site restoration costs, accounting for reserves, disclosures and hedge accounting. The program provides guidance on accounting issues relating to joint ventures and production sharing agreements and includes an overview of the interpretation IFRIC 20 “Stripping Costs in the Production Phase of a Surface Mine”.

Also included is a review of US GAAP relevant to extractive industries.

The course answers questions such as:

- What are the accounting and disclosure requirements of IFRS 6 Exploration for and Evaluation of Mineral Resources?

- What are the different accounting requirements for production and exploration assets?

- How does the diversity in accounting practices in the extractive industry affect financial reporting and what is the IASB’s response?

- How does IFRS 1 First-time Adoption of International Financial Reporting Standards apply to extractive industries, what are the first-time adoption rules, and how will this affect your transition?

- How does IFRS relate to asset retirement and costs associated with decommissioning mines as well as restoration/rehabilitation?

- What are the critical compliance issues relating to hedge accounting?

- When are options available for valuing tangible assets (property, plant and equipment) and what are the optional treatments?

- When are options available for valuing intangible assets and what are the optional treatments?

- How are the recognition and measurement rules for impairment applied?

- What are some of the issues specific to mining sector business combinations?

- In what manner are joint ventures structured in the minerals and mining sector?

- How are stripping costs in the production phase of a surface mine accounted for?

- Non-renewable reserves

- Scale of capital investment

- Pattern of cash flows

- Risks

- Variety of business structures

Accounting issues in the minerals and mining industry

- The challenge of representing the mining industry in a context of historical cost accounting

- Disparity between cost and value

- Exploration: capitalisation vs. expense

- Capitalised costs

-

- Impairment

-

- Fixed assets

- Reserves and other disclosures

Resources and reserve statements and other disclosures

- Reserve definitions and disclosures

- Use of reserves in accounting

- Other disclosures

- Examples of published disclosures

- Objectives

- Recommendations

- Role of the IASB Framework for the Preparation and Presentation of Financial Statements

Exploration for and evaluation of mineral resources (IFRS 6)

- Recognition and measurement

- Reclassification

- Impairment

- Disclosures

- Asset categories

- Directly capitalised vs. transferred from exploration and evaluation

- Depreciation, depletion and amortisation

- Capitalisation of borrowing costs – IAS 23

- Cost model vs. revaluation model

- Revenue in development phase – amendment to IAS 16

- Why is impairment an issue for the minerals and mining industry?

- General rules for impairment testing

- Cash-generating units

- Recognition and measurement of impairment losses

- Reversal of impairment losses

Decommissioning costs and site restoration (IAS 37)

- Recognition of liability

- Changes to decommissioning liabilities – IFRIC 1

- Worked example

- Disclosures

Production

- Commissioning and production

- Depreciation (IAS 16, IAS 38)

- Stripping costs in the production phase of a mine (IFRIC 20)

- Revenue (IFRS 15)

- Taxes (IAS 12)

- Leases (IFRS 16)

Financial instruments (IFRS 9)

- Summary of the principles in IAS 39 and IFRS 9

- Expected credit losses

- Risk management in the minerals and mining industry

- Hedge accounting

- Practical issues

- Disclosures

Group accounting and consolidation

- Business combinations (IFRS 3)

- Control and consolidation of subsidiaries (IFRS 10 and IAS 27)

- Significant influence and equity accounting of associates (IAS 28)

- Joint control and equity accounting of joint ventures/proportionate consolidation of joint operations (IFRS 11)

- Step acquisitions

- Step disposals

- Other common group and consolidation issues in the mining industry

- Disclosures (IFRS 12)

This course is delivered in an interactive workshop format - either in person or online - with a strong emphasis on real-world application.

- Group live or group internet-based instruction by expert facilitators tailored to the unique accounting issues faced in the mining sector

- Hands-on case studies and worked examples, allowing participants to apply IFRS concepts in context

- Facilitated group discussions and Q&A sessions that encourage knowledge sharing and exploration of practical challenges

- In line with VantagePoint’s sustainability commitment, course materials are provided in digital format. Printed handouts will be limited to in-class exercises only.

This course gives you 16 hours of CPE/CPD credits.

VantagePoint is currently in the process of registering with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

Our face-to-face courses are typically held in meeting rooms at centrally located four-star hotels. If you have any queries about the venue for your selected training, please don't hesitate to ask. We will provide updates and ensure that you have all the details you need.

Virtual courses are delivered via Zoom.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

Bring this course in-house

Do you need to upskill your team? We specialise in the design and delivery of bespoke events for finance and sustainability teams.

Contact us to discuss your requirements - we'd love to hear how we can help.

Bespoke options for your team

Our course schedule can change based on demand from our clients. If there's a new topic that you'd like to see please let us know.

Stay updated

To stay up to date with news on our latest courses, topics, webinars and free in person events sign up to our newsletter using the button below.

Bring this course in-house

Bespoke options for your team

Stay updated

VantagePoint Training attendee

HSS Hire - attendee

Chinonso Nwagbara

Five day course - attendee

VantagePoint Training attendee

CIIPA - attendee

"Very professional and efficient service - kept to allocated timings and audio/visual was very smooth."

VantagePoint Training attendee

EUMETSAT - attendee

Trusted by

.svg)