IFRS update and ESG briefing

Get up to speed on critical IFRS and sustainability reporting changes in just two days

This essential two-day CPD/CPE course updates finance professionals on key developments in financial and sustainability reporting. Day one covers the latest IFRS standards, amendments and exposure drafts with practical application guidance. Day two focuses on sustainability reporting, offering a clear overview of the ESG landscape and major frameworks (including CSRD and IFRS S1 and S2) equipping participants with everything needed to navigate today’s evolving reporting requirements.

£1,950*

*excl VAT for UK courses

Learning objectives

At the end of this course, participants will be able to:

- Discuss new IFRS Accounting Standards (IFRS 18 and IFRS 19) and explain recent and upcoming amendments to existing IFRS Accounting Standards while learning how to implement them

- Relate recent real-world examples of best practice in IFRS reporting

- Improve the quality of disclosures in IFRS financial statements in preparation for increased regulator scrutiny

- Minimise the learning curve for getting up to speed on the essentials of ESG and ESG reporting

- Describe the key current frameworks for ESG and sustainability reporting

- Recognise the fast-moving development of an internationally applicable framework for ESG and sustainability reporting, including the application of IFRS S1 and IFRS S2

- Plan ahead for the future implementation of the changes in corporate reporting.

Who should attend?

- Accountants in finance and reporting teams that prepare IFRS financial statements

- External and internal auditors

- Financial and credit analysts who review financial statements

- Accountants who are involved in the development and implementation of ESG and sustainability reporting

- Financial analysts who review the content of sustainability reports.

What's included?

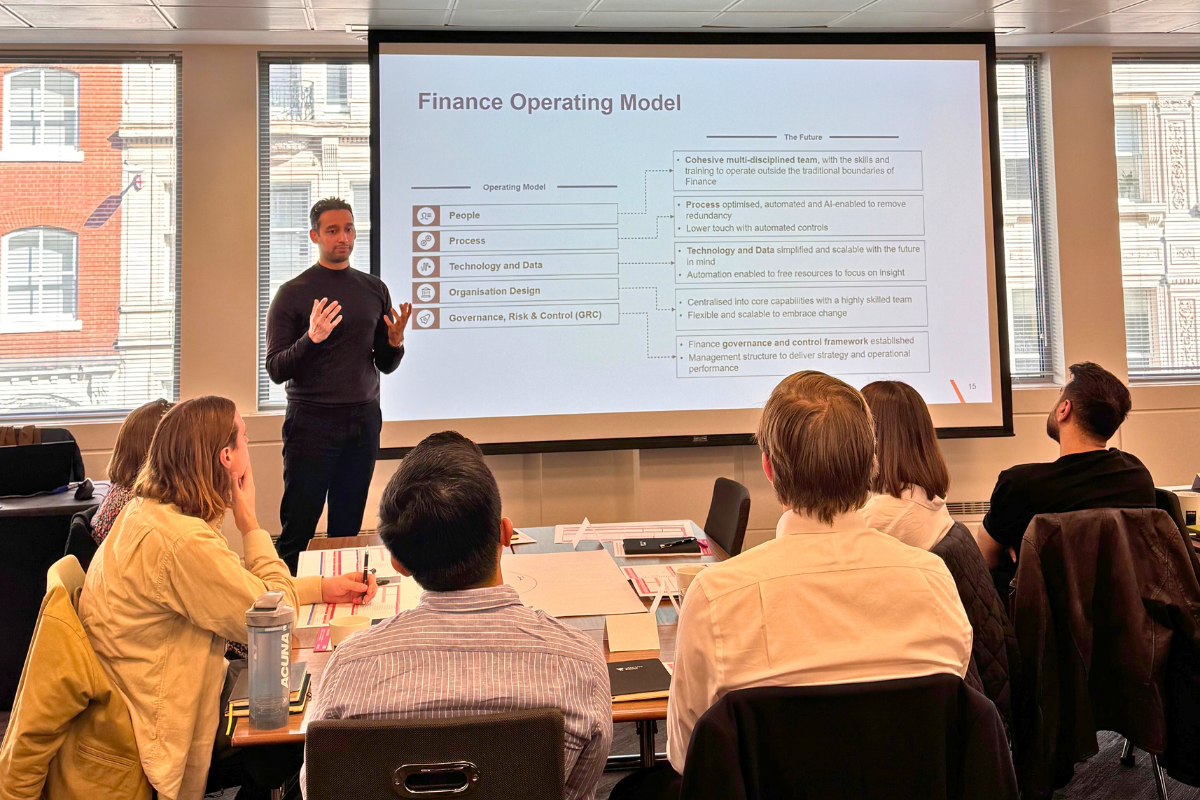

- Group live instruction with expert facilitators using illustrative examples to explain key IFRS and ESG developments

- Use of model IFRS financial statements and worked examples to bring technical concepts to life

- Hands-on workshop exercises featuring realistic scenarios, case studies and examples of best practice—plus practical tools and templates you can apply directly in your role

- Interactive participation is encouraged throughout, with opportunities for discussion, reflection and peer learning

What can I expect?

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

- Well-equipped classrooms - all our courses take place in well-located, great quality hotels or event spaces with excellent facilities

- Your very own VantagePoint welcome pack.

Your IFRS update and ESG briefing course in detail

In-depth information about the course

The course commences with an update on new standards applicable from 2024 and onwards. This is followed by analysis of the new IFRS 18 Presentation and Disclosure in Financial Statements which replaces IAS 1 Presentation of Financial Statements effective from 1 January 2027. The key changes in IFRS 18 relate to structure of the statement of financial performance, reporting of management-defined performance measures and grouping of information. The standard has an impact on companies in all sectors.

In addition to IFRS 18, the International Accounting Standards Board (IASB) has also published IFRS 19 Subsidiaries without Public Accountability: Disclosures. We will review the requirements and impact of IFRS 19, also effective from 1 January 2027.

The economic uncertainty and focus on climate reporting has put the spotlight on several key accounting topics, especially those that require the exercise of judgement in the measurement of amounts to be reported in the financial statements. Regulators are paying particular attention to these and are requiring ever more robust and company-specific disclosures about them. In light of this, we will consider the focus areas for key regulators.

The demand for ESG information is gaining traction like never before, and the course continues with a briefing on the essentials of ESG, the drivers of demand for ESG data and a possible schematic for ESG reporting. We then move on to provide an update on the latest developments relating to the ESG regulatory reporting framework. We will walk through the requirements of the IFRS Sustainability Disclosure Standards (IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures) published by the International Sustainability Standards Board (ISSB). In addition, we will also review the sustainability reporting developments in the EU through the adoption of the Corporate Sustainability Reporting Directive (CSRD).

New IFRS accounting standards

- IFRS 18 presentation and disclosure in financial statements

- Key changes from IAS 1 for better communication with investors

- IFRS 19 Subsidiaries without Public Accountability: Disclosures

- Amendments applicable from 2024 and onwards

Current IFRS standard setters’ workplan

- Research projects

- Maintenance projects

- Standard setting projects

Regulators’ concerns and topics in the spotlight due to economic uncertainty and climate change

Games:

- Spot the company balance sheet

- Spot the industry ESG profile

What's happening with ESG and sustainability reporting?

- ESG overview and some war stories

- Sustainability reporting vs financial reporting

- The problems of “alphabet soup” and “greenwashing”

- ESG materiality – a very different way of thinking - a study of some cases

- IFRS Sustainability Disclosure Standards - IFRS S1 and IFRS S2 and an update on the current work plan of the International Sustainability Standards Board (ISSB)

- Mandatory requirements in the European Union - EU Taxonomy and CSRD, including the proposed Omnibus package.

This course is delivered through a practical, interactive format designed to support real-world application and active engagement.

- Group live instruction with expert facilitators using illustrative examples to explain key IFRS and ESG developments

- Use of model IFRS financial statements and worked examples to bring technical concepts to life

- Hands-on workshop exercises featuring realistic scenarios, case studies and examples of best practice—plus practical tools and templates you can apply directly in your role

- Interactive participation is encouraged throughout, with opportunities for discussion, reflection and peer learning

- In line with VantagePoint’s sustainability commitment, course materials are provided in digital format. Printed handouts will be limited to in-class exercises only.

This course provides 16 hours of CPE/CPD credits.

VantagePoint Training is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org. For information regarding administrative policies such as our complaint policy and refund policy, please contact us.

Our face-to-face courses are typically held in meeting rooms at centrally located four-star hotels. If you have any queries about the venue for your selected training, please don't hesitate to ask. We will provide updates and ensure that you have all the details you need.

Virtual courses are delivered via Zoom.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

Bring this course in-house

Do you need to upskill your team? We specialise in the design and delivery of bespoke events for finance and sustainability teams.

Contact us to discuss your requirements - we'd love to hear how we can help.

The courses you need

Not seeing the ideal course? Our course schedule is driven by demand. If your chosen course is not scheduled, or there’s a topic, date or location you’d like to see,. please let us know.

Stay updated

To stay up to date with news on our latest courses, topics, webinars and free in person events sign up to our newsletter using the button below.

Bring this course in-house

The courses you need

Stay updated

VantagePoint Training attendee

HSS Hire - attendee

Chinonso Nwagbara

Five day course - attendee

VantagePoint Training attendee

CIIPA - attendee

"Very professional and efficient service - kept to allocated timings and audio/visual was very smooth."

VantagePoint Training attendee

EUMETSAT - attendee

Trusted by

.svg)