IFRS workshop for banks and financial institutions

IFRS training focused on financial institutions and the banking industry

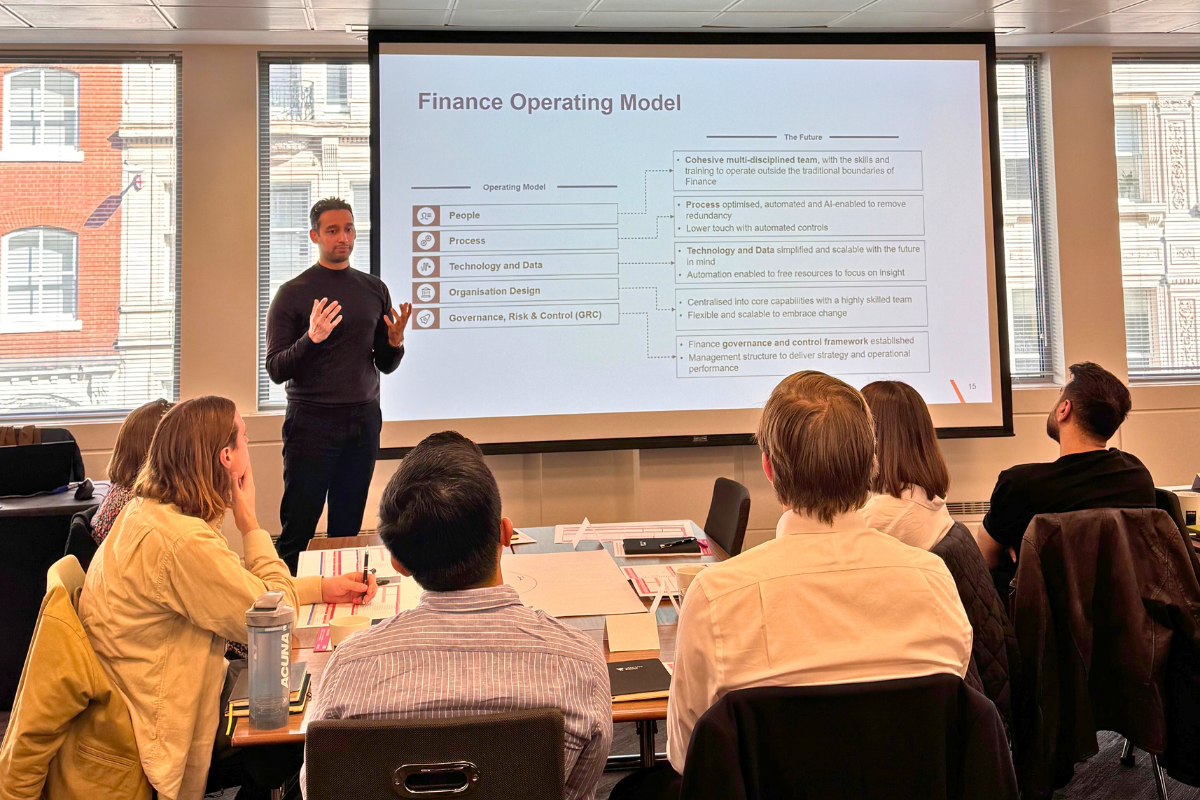

This immersive five-day workshop is designed specifically for finance professionals in banks and other financial institutions seeking a deep and practical understanding of IFRS. Through real-world case studies and interactive sessions, you'll strengthen your ability to apply the standards with confidence. You’ll cover all the key areas that matter, including IFRS 9, IFRS 15 and other critical updates shaping financial reporting today.

£4,750*

*excl VAT for UK courses

Learning objectives

At the end of this course, participants will be able to:

- Prepare and analyse IFRS financial statements, including statements of financial position, statements of profit or loss and other comprehensive income, statement of cash flows, statement of changes in equity and the notes to the financial statements

- Comply with the extensive IFRS disclosure requirements, including accounting policies and changes in accounting policies, earnings per share, related parties, operating segments and the qualitative and quantitative disclosures for financial instruments

- Apply IFRS requirements for recognition and measurement of assets, liabilities, revenues, expenses, gains and losses

- Classify and measure financial assets under IFRS 9

- Calculate the effective interest rates for various financial instruments common to the banking industry and apply the effective interest method for recognition of interest income and expense

- Differentiate embedded derivatives between those that must be accounted separately and those that do not require separation from their host instruments under IFRS 9

- Calculate impairment of loans and other financial assets in accordance with IFRS 9, as well as impairment of non-financial assets using the “cash-generating units” approach in accordance with IAS 36

- Apply IFRS requirements for hedge accounting, repossessed assets, loan commitments, loan fees and financial guarantees

- Analyse the five-step framework for recognition of revenue in IFRS 15 (revenue from contracts with customers) and apply the principles to recognition of income in the banking and financial services industry

- Apply IFRS 16’s lease accounting model and analyse its impact on the financial statements.

Who should attend?

- Financial accountants and management accountants in the financial services sector seeking in-depth knowledge of all accounting standards and interpretations most relevant to the industry

- Accounting staff and management of banks and other financial institutions that are adopting IFRSs for the first time or have already adopted IFRSs and want to reinforce their understanding of the accounting and reporting requirements

- Internal and external auditors of entities in the financial services sector reporting under IFRSs

- Staff and management of central banks, deposit insurance entities and other agencies with regulatory responsibility in the financial services sector

- Financial analysts seeking to improve their understanding of the accounting and disclosures by banks and other financial institutions.

What's included?

- Group live instruction sessions led by IFRS specialists with deep experience in financial institutions

- Interactive discussions to explore real-world application and share insights with peers

- Clear, accessible explanations of IFRS technical requirements, with a strong focus on financial instruments and the standards most relevant to financial institutions

- Presentations supported by real-life examples, practical calculations and live Q&A

- Targeted exercises and case studies enabling participants to apply concepts in a practical context.

What can I expect?

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

- Well-equipped classrooms - all our courses take place in well-located, great quality hotels or event spaces with excellent facilities

- Your very own VantagePoint welcome pack.

Your IFRS for banks and financial institutions course in detail

In-depth information about the course

This workshop provides a detailed review of the significant technical requirements of International Financial Reporting Standards (IFRSs), including accounting and reporting for financial instruments, as well as other standards relevant to the financial services sector. It includes coverage of the requirements of the relevant standards, hands-on case studies, examples, exercises, small-group projects and benefits from the interactive participation of the attendees. Our specialist instructors explain the principles clearly and simply while providing real-world examples, thereby immersing participants in the intricacies of IFRSs and the implications for banks and other financial institutions.

Utilising a highly interactive format, the workshop provides a comprehensive overview of the effects that IFRS 9 (financial instruments) has on the financial statements of financial institutions, including updates to the standard as part of the post-implementation review and disclosure expectations set out by key regulators.

Introduction to IFRSs

- IFRSs and the IASB structure

- Overview and organisation of the standards

- IFRS (conceptual framework)

- Overview of primary IFRS financial statements

- Concept of "other comprehensive income"

- Time value of money

- IFRS 13 (fair value measurement)

Financial statements

- IAS 1 (presentation of financial statements)

- IAS 7 (statement of cash flows)

- IAS 8 (accounting policies, changes in accounting estimates and errors)

- IAS 10 (events after the reporting period)

- IAS 33 (earnings per share)

- IAS 34 (interim financial reporting)

- IFRS 8 (operating segments)

- IFRS 18 (presentation and disclosure in financial statements) – replaces IAS 1 from 1 January 2027

Financial instruments

- IAS 32 (financial instruments: presentation)

- Distinguishing between financial liabilities and equity transactions

- Offsetting financial assets and financial liabilities

IFRS 9 (financial instruments)

- Classification and reclassification of financial instruments

- Solely Payments of Principal and Interest (SPPI) and business model criteria

- The "fair value option"

- Initial and subsequent measurement

- Derivatives and embedded derivatives

- Calculation of effective interest rates and application of the effective interest method under various scenarios

- Repossessed assets

- Loan fees and origination costs

- Financial guarantees and loan commitments

- Derecognition of financial instruments

- Updates to IFRS 9 classification and measurement

- Application of the expected credit loss model

- 12-month and lifetime expected credit losses

- Significant increase in credit risk

- Measurement of expected credit losses

- Modified financial assets

- Simplification and practical expedients

- Purchase/origination of credit-impaired financial assets

- Hedge accounting model

- Overview of hedging and accounting for three types of hedges – fair value, cash flow and net investment hedge

- Impact of hedge accounting for interest rate and foreign exchange risk

- IFRS 9 hedge accounting principles: Hedged items, hedging instruments, qualifying criteria, groups and net positions, hedge documentation, hedge effectiveness requirements, rebalancing and discontinuation

- Update on the dynamic risk management (macro hedging) project

IFRS 7 (financial instruments: disclosures) including expectations set out by UK and European regulators

Other standards as applicable to banks and financial institutions

Non-financial assets

- IAS 16 (property, plant and equipment)

- IAS 23 (borrowing costs)

- IAS 38 (intangible assets)

- IAS 40 (investment property)

- IAS 36 (impairment of assets)

Liabilities and leases

- IAS 37 (provisions, contingent liabilities and contingent assets)

- IAS 19 (employee benefits)

- IFRS 16 (leases)

Revenue and other standards

- IFRS 15 (revenue from contracts with customers)

- IAS 21 (the effects of changes in foreign exchange rates)

- IFRS 1 (first-time adoption of IFRSs (reliefs from retrospective application)

This course is delivered through a dynamic blend of expert-led instruction and hands-on learning designed to maximise engagement and practical understanding.

- Group live instruction sessions led by IFRS specialists with deep experience in financial institutions

- Interactive discussions to explore real-world application and share insights with peers

- Clear, accessible explanations of IFRS technical requirements with a strong focus on financial instruments and the standards most relevant to financial institutions

- Presentations supported by real-life examples, practical calculations and live Q&A

- Targeted exercises and case studies enabling participants to apply concepts in a practical context

- In line with VantagePoint’s sustainability commitment, course materials are provided in digital format. Printed handouts will be limited to in-class exercises only

This course provides 40 hours of CPE/CPD credits.

VantagePoint Training is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org. For information regarding administrative policies such as our complaint policy and refund policy, please contact us.

Our face-to-face courses are typically held in meeting rooms at centrally located four-star hotels. If you have any queries about the venue for your selected training, please don't hesitate to ask. We will provide updates and ensure that you have all the details you need.

Virtual courses are delivered via Zoom.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

Bring this course in-house

Do you need to upskill your team? We specialise in the design and delivery of bespoke events for finance and sustainability teams.

Contact us to discuss your requirements - we'd love to hear how we can help.

The courses you need

Not seeing the ideal course? Our course schedule is driven by demand. If your chosen course is not scheduled, or there’s a topic, date or location you’d like to see,. please let us know.

Stay updated

To stay up to date with news on our latest courses, topics, webinars and free in person events sign up to our newsletter using the button below.

Bring this course in-house

The courses you need

Stay updated

VantagePoint Training attendee

HSS Hire - attendee

Chinonso Nwagbara

Five day course - attendee

VantagePoint Training attendee

CIIPA - attendee

"Very professional and efficient service - kept to allocated timings and audio/visual was very smooth."

VantagePoint Training attendee

EUMETSAT - attendee

Trusted by

.svg)