International upstream oil and gas accounting comprehensive workshop

The most comprehensive IFRS workshop focused on international upstream oil and gas

This immersive five-day course is essential for finance professionals in the upstream oil and gas sector. It covers IFRS-based reporting on exploration, reserves, production sharing, conveyancing, decommissioning and more, with comparisons to US GAAP. Through real-world scenarios, case studies and expert-led discussions, participants gain practical insights to confidently handle the sector’s complex and varied accounting challenges.

£4,750*

*excl VAT for UK courses

Learning objectives

At the end of this course, participants will be able to:

- Apply IFRS to oil and gas exploration, development and production activities

- Judge when to capitalise and when to expense under IFRS during exploration and development

- Identify the differences in treatment between accounts prepared under IFRS and those prepared under PSAs

- Evaluate the impact of using different units of production methods to calculate DD&A

- Describe the principal assumptions needed to conduct impairment reviews and to establish decommissioning provisions under IFRS

- When and how to assess unproved and proved properties for impairment

- Calculate and interpret financial and operational metrics used to analyse costs, profitability, efficiency and value added by a firm's exploration and production activities

- Prepare cash call requests, joint billing statements and cut back entries

- Develop the key components of an oil and gas chart of accounts

- Evaluate the impact of acquisitions, disposals and exchanges of oil and gas properties on the financial statements.

Who should attend?

- Financial accountants in the oil and gas industry

- Management accountants of IOCs and NOCs

- Internal and external auditors of oil and gas companies reporting under IFRS

- Staff of revenue authorities and NOCs working with IOCs.

What's included?

- Group live instruction by experts focusing on the real-world challenges of upstream oil and gas accounting

- Industry-specific case studies and hands-on exercises to apply IFRS and compare with US GAAP treatments

- Facilitated group discussions and Q&A to explore diverse practices and complex scenarios

- Use of illustrative financial statements, models and practical tools that participants can adapt for their organisations.

What can I expect?

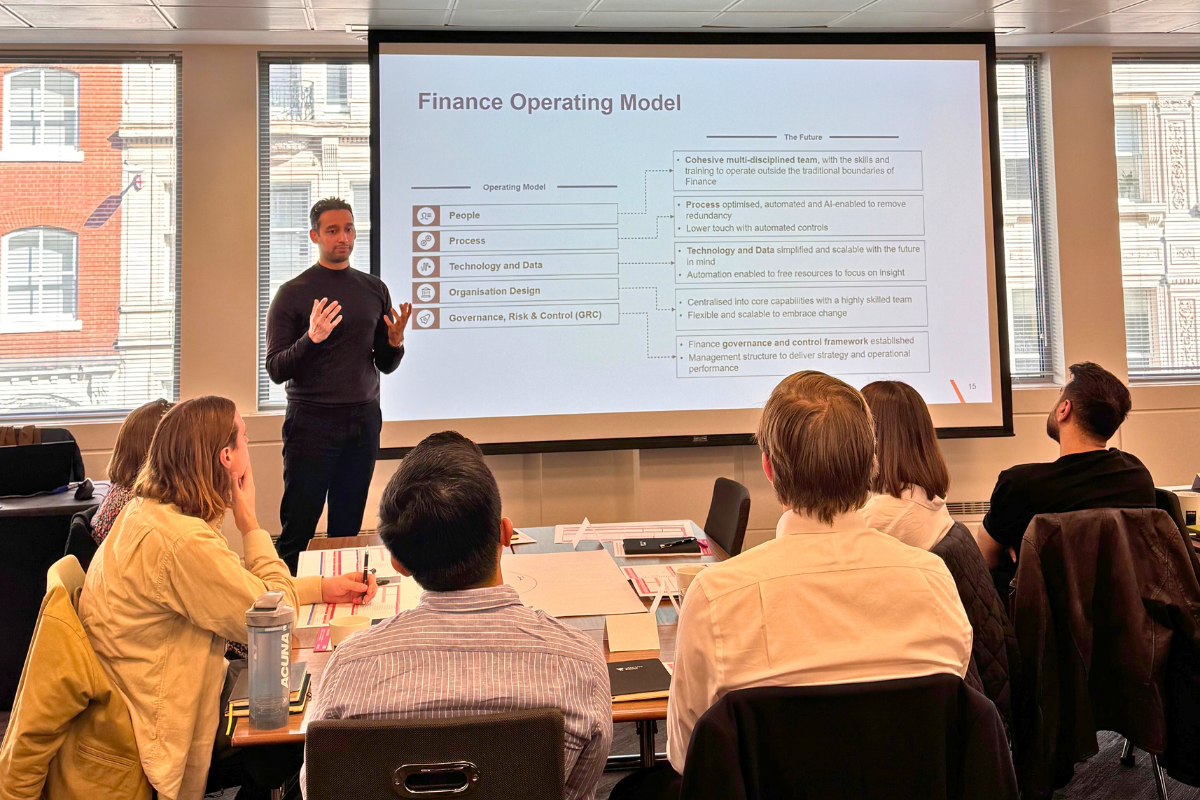

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

- Well-equipped classrooms - all our courses take place in well-located, great quality hotels or event spaces with excellent facilities

- Your very own VantagePoint welcome pack.

Your International upstream oil and gas accounting course in detail

In-depth information about the course

This workshop provides a detailed review of significant IFRS requirements for the upstream oil and gas sector, including regulatory reporting and the diverse accounting practices that arise from the many commercial and contracting arrangements which are unique to it. It includes coverage of IFRSs, hands-on case studies, examples, exercises and benefits from the interactive participation of the attendees. The program includes the latest pronouncements, and participants are brought up to date on all topics. In addition, participants are provided with information to assist them in researching accounting issues and monitoring future changes.

This course looks in depth at accounting practices permitted by IFRS 6 within the exploration and development phase by reviewing these against benchmark treatments in US GAAP. It goes on to consider how IFRS is applied in the development and production phases. In doing so, it looks at the unique features posed by joint venture operations and contracting arrangements, in particular, production sharing agreements. Detailed treatments of revenues, costs and accounting for taxation arrangements and conveyances will also be considered. In addition, the application of IFRS best practices in management reporting will be considered, including chart of accounts, reporting by operators to partners and key financial and reserves reporting metrics used by the industry.

This course is ideal for individuals with financial responsibilities who are new to the oil and gas industry or for accountants operating in the industry. It will review accounting requirements from pre-exploration to production for reporting internally, externally and to partners under the unique contractual arrangements common to this industry.

Presented by experienced instructors with both oil and gas and IFRS expertise, this program gives participants the benefit of decades of IFRS experience. The workshop style of this course ensures that delegates have the opportunity to ask questions while receiving thorough answers based on the presenter’s past experiences. Our specialist instructors explain the principles clearly and simply while providing real-world examples.

This course answers questions such as:

- How to understand and apply IFRS to oil and gas exploration, development and production activities.

- When to capitalise and when to expense under IFRS during exploration and development and how does the diversity in accounting practices in the extractive industry affect financial reporting?

- How do IFRS reporting requirements interact with reporting between venturers and the State?

- What are the characteristics of PSAs and how are these reflected in the financial statements?

- What methods of units of production calculation are permitted and what is best practice?

- When and how to assess unproved and proved properties for impairment?

- What are the main revenue recognition issues faced by the industry?

- How do different tax regimes impact financial reporting?

- How to calculate and interpret financial and operational metrics used to analyse the costs, profitability, efficiency and value added by a firm's exploration and production activities?

- How do oil and gas companies present their financial statements when reporting under IFRS?

- What are the implications for the oil and gas industry of the IASB's project on extractive industries and of other current IFRS developments?

- How does the investor in a joint venture account for its interest and how does the operator account to its partners?

- How does an oil and gas company establish its chart of accounts?

- What are the management accounting and reporting requirements internally and between venturers?

- What does IFRS have to say about asset exchanges and conveyances of oil and gas interests?

- How to account for decommissioning costs and rehabilitation funds under IFRS.

Fundamental concepts of oil and gas accounting methods

- Characteristic features of the oil and gas industry

- Scale of operations

- Nature and timing of cash flows

- Risks

IFRS fundamentals

- The conceptual framework

- Selection of accounting policies (IAS 8)

- Overview of successful efforts vs. full cost methods

Concepts of oil and gas accounting

- Life cycle of operations

- Interaction between IFRS and national oil and gas reporting practices as developed by the USA and other countries

Presentation of financial statements by IFRS reporters

- Application of IAS 1 presentation, and IAS 7 statement of cash flows and IFRS 8 operating segments

- Influence on presentation of past practices and regulatory listing requirements

- Introduction to reporting of oil and gas operations, properties and reserves

Accounting for exploration and evaluation

- IFRS definitions of tangible and intangible assets (IAS 16 and IAS 38) and scope exclusions

- Accounting for pre-exploration expenditures

- Review of purpose and nature of IFRS 6

- Full cost methods of accounting during the exploration and evaluation stage comparing US GAAP treatments to those permitted under IFRS 6

- Successful efforts methods during exploration and evaluation, comparing US GAAP treatments to those permitted under IFRS 6

- Treatment of non-drilling exploration activities, dry holes, appraisal activities, impairment reviews of unproved property and upon completion of evaluation

- Comparison of benchmark methods to other treatments found under IFRS

Accounting for development

- Distinguishing between development activities and exploration or production activities

- Treatment of dry holes and unanticipated expenditures

- Application of impairment methods under IAS 36

- Application of IAS 38 and IAS 16 to development phase activities

Borrowing costs

- Application of IAS 23, capitalisation of borrowing costs to exploration and development

- When to commence and cease capitalisation

- What rate to use

Retirement obligations/decommissioning

- Review of provision principles in IAS 37

- Application to environmental damage

- Application to asset retirement obligations, when to commence recognition, how to estimate the liability, what discount rate to use, how to account for changes in estimates

- Accounting for rehabilitation funds (IFRIC 5)

Production

- Stores and warehouse inventory

- Workovers and recompletions

- Methods of depreciation, depletion and amortisation, defining the cost centre, which reserves to use, how to adjust the numerator, shared production and depreciating common facilities

- Asset impairment during the production phase

Revenue recognition

- Revenue recognition under IFRS 15

- Application to recognition (production, lifting, production inventory (IAS 2)

Reporting of reserves

- Supplementary disclosure requirements relating to oil and gas producing activities required by SEC and other regulators, including COGEH

- Best practices from other IFRS reporters

- SEC oil and gas modernisation act

- Where to find key data relating to firms' exploration and production activities

- Proved oil and gas reserve quantities

- Costs incurred for property acquisition, exploration and development activities

- The standardised measure of discounted future net cash flows ('PV10')

- Update on the IASB's project for extractive industries financial reporting

Performance metrics

- Review of typical metrics used by analysts (internal and external)

- Computation of metrics using published property, reserves and operational information

Taxation of oil and gas

- Typical tax regimes

- Distinguishing between revenue-based taxes and income-based taxes

- Accounting for and presentation of revenue-based taxes

- Accounting for taxation under IAS 12, including super taxes

- Application of IAS 12 to oil and gas assets and decommissioning liabilities

Joint operations and joint ventures

- Reasons for joint arrangements in the industry

- Nature of joint venture and joint operations

- Accounting for contributions by the venturers

- Under and over lift and diverse methods of accounting for it

- Identification of joint ventures (entities) and accounting for them under IAS 28 in the economic entity and separate financial statements

Production sharing agreements (PSA/PSC)

- What are PSA’s and where are they found?

- What are the typical provisions within a PSA?

- Running the economics of a PSA, impact on reserves and production

- Cost oil and profit oil and revenue share

- Pre and post-tax arrangements, including tax barrels and pay on behalf of regimes

- Understanding the differences between IFRS treatments and PSA treatments of capex, opex, recoverable and unrecoverable costs

- IFRS treatment of oil and gas assets, reporting of reserves and calculating DDA in PSAs

- Comparison with treatments under other contractual arrangements (risk sharing and technical service agreements)

Accounting for acquisitions, asset exchanges and conveyances

- Typical types of acquisition, exchange and conveyances within the industry

- Identification of asset acquisitions from business combinations (application of IFRS 3) and impact upon accounting

- Recognition and measurement of goodwill arising from business combinations

- Asset exchanges in the exploration phase and relevance of US GAAP treatments in an IFRS environment

- Treatments of pooling of interests, unitisations and farm-in, farm-out arrangements, comparing US GAAP treatments to treatments emerging under IFRS

- Asset exchanges involving cash consideration and partial and full disposals of properties

This course is delivered in an immersive workshop-style format designed to bridge technical knowledge with practical application:

- Group live instruction by experts focusing on the real-world challenges of upstream oil and gas accounting

- Industry-specific case studies and hands-on exercises to apply IFRS and compare with US GAAP treatments

- Facilitated group discussions and Q&A to explore diverse practices and complex scenarios

- Use of illustrative financial statements, models and practical tools that participants can adapt for their own organisations

- In line with VantagePoint’s sustainability commitment, course materials are provided in digital format. Printed handouts will be limited to in-class exercises only.

This course provides 40 hours of CPE/CPD credits.

VantagePoint Training is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org. For information regarding administrative policies such as our complaint policy and refund policy, please contact us.

Our face-to-face courses are typically held in meeting rooms at centrally located four-star hotels. If you have any queries about the venue for your selected training, please don't hesitate to ask. We will provide updates and ensure that you have all the details you need.

Virtual courses are delivered via Zoom.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

Bring this course in-house

Do you need to upskill your team? We specialise in the design and delivery of bespoke events for finance and sustainability teams.

Contact us to discuss your requirements - we'd love to hear how we can help.

The courses you need

Not seeing the ideal course? Our course schedule is driven by demand. If your chosen course is not scheduled, or there’s a topic, date or location you’d like to see,. please let us know.

Stay updated

To stay up to date with news on our latest courses, topics, webinars and free in person events sign up to our newsletter using the button below.

Bring this course in-house

The courses you need

Stay updated

VantagePoint Training attendee

HSS Hire - attendee

Chinonso Nwagbara

Five day course - attendee

VantagePoint Training attendee

CIIPA - attendee

"Very professional and efficient service - kept to allocated timings and audio/visual was very smooth."

VantagePoint Training attendee

EUMETSAT - attendee

Trusted by

.svg)