IPSAS 43: Accounting for leases

Prepare now for the transition to IPSAS 43 with clear, practical guidance on the new lease accounting rules

This dynamic two-session virtual course explores IPSAS 43, which replaces IPSAS 13 from 1 January 2025. Participants will gain a clear understanding of key changes in lease accounting, including recognition, measurement and financial statement impacts. Through expert-led sessions, practical insights and real-world examples, the course equips finance professionals with the tools to confidently manage the transition to IPSAS 43 and apply it effectively within their organisations.

£1,950*

*excl VAT for UK courses

Learning objectives

At the end of this course, participants will be able to:

- Comply with the new accounting and disclosure requirements for leases

- Analyse contracts to determine whether they contain leases

- Apply the rules for initial and subsequent measurement by lessees and lessors

- Learn the requirements for sale and leaseback transactions

- Plan the transition to IPSAS 43.

Who should attend?

- Accountants and public financial management (PFM) officials who prepare IPSAS financial statements in finance and reporting teams

- External and internal auditors of public sector entities who prepare accrual-basis IPSAS financial statements

- Consultants, analysts and academics with interests in public sector financial reporting.

What's included?

- Group internet-based instruction by IPSAS specialists, offering deep insights into the nuances of IPSAS 43 and its implications on lease accounting

- Real-world case studies and worked examples to demonstrate the application of the new lease accounting standards in various scenarios

- Step-by-step walkthroughs of key topics such as lease recognition, measurement and presentation in financial statements

- Interactive group discussions and Q&A sessions that foster knowledge sharing and problem-solving on common implementation challenges

- Hands-on workshop exercises to apply IPSAS 43 concepts directly to participants' organisational contexts.

What can I expect?

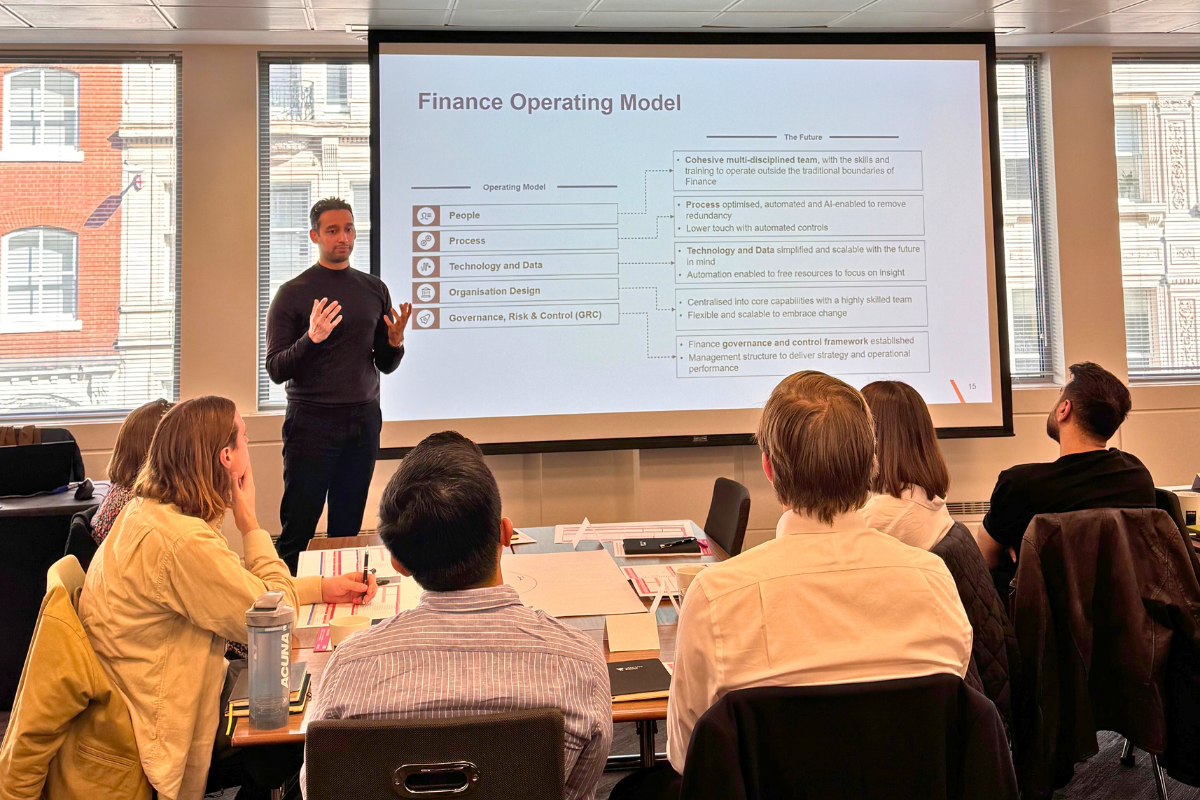

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

- Well-equipped classrooms - all our courses take place in well-located, great quality hotels or event spaces with excellent facilities

- Your very own VantagePoint welcome pack.

Your IPSAS 43: Accounting for leases course in detail

In-depth information about the course

IPSAS 43 is aligned with the IASB’s leasing standard, IFRS 16. It also addresses arrangements which are specific to the public sector, such as concessionary leases and rights to use assets for no consideration.

The most important changes required by IPSAS 43 relate to lessee accounting. Under the ‘right-of-use model’, leases will be recognised on the lessee’s statement of financial position by recognising a right to use the underlying asset and a liability to make future lease payments. This will bring most existing leases ‘on balance sheet’. Exceptionally, where criteria are met, leases may apply separate recognition exemptions for short-term leases and leases of low-value assets: where used, lessees will account for these similarly to operating leases under IPSAS 13.

IPSAS 43 substantially carries forward lessor accounting under IPSAS 13: lessors must continue to distinguish between finance and operating leases. Changes include clarifying how to deal with lease modifications and accounting for subleases.

The new standard contains extensive application guidance and is accompanied by illustrative examples, which will be referenced in the course. Using case studies, examples and exercises, our specialist instructors explain and illustrate how to apply the requirements of IPSAS 43.

This program answers questions such as:

- How must arrangements be analysed to determine whether they contain leases?

- How are contracts separated into lease and non-lease components?

- How are leases accounted for in the financial statements of lessees?

- What changes does IPSAS 43 make to accounting by lessors?

- What are the presentation and enhanced disclosure requirements?

- What are the requirements and options for transitioning to the new standard?

Leases

- Defining a lease

- Separating a contract into lease and non-lease components

- Recognition exemptions for short-term leases and leases of low-value assets

- Determining the lease term

Lessee accounting

- Recognition – right-of-use model

- Initial and subsequent measurement

- Lease modifications

- Presentation

- Disclosure

Lessor accounting

- Classification as operating or finance leases

- Finance leases - recognition and measurement

- Operating leases - recognition and measurement

- Presentation

- Disclosure

Sale and leaseback transactions

- Assessing whether a transfer is a sale or a financing

- Recognition and measurement by seller-lessees and buyer-lessors

Public sector-specific arrangements

- Concessionary leases

- Rights to use assets for no consideration

Transitioning to IPSAS 43

This course is delivered in a highly interactive, expert-led format designed to ensure participants gain both technical knowledge and practical skills:

- Group internet-based instruction by IPSAS specialists, offering deep insights into the nuances of IPSAS 43 and its implications on lease accounting

- Real-world case studies and worked examples to demonstrate the application of the new lease accounting standards in various scenarios

- Step-by-step walkthroughs of key topics such as lease recognition, measurement and presentation in financial statements

- Interactive group discussions and Q&A sessions that foster knowledge sharing and problem-solving on common implementation challenges

- Hands-on workshop exercises to apply IPSAS 43 concepts directly to participants' organisational contexts

- In line with VantagePoint’s sustainability commitment, course materials are provided in digital format. Printed handouts will be limited to in-class exercises only.

This course provides 16 hours of CPE/CPD credits.

VantagePoint Training is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org. For information regarding administrative policies such as our complaint policy and refund policy, please contact us.

Our face-to-face courses are typically held in meeting rooms at centrally located four-star hotels. If you have any queries about the venue for your selected training, please don't hesitate to ask. We will provide updates and ensure that you have all the details you need.

Virtual courses are delivered via Zoom.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

Bring this course in-house

Do you need to upskill your team? We specialise in the design and delivery of bespoke events for finance and sustainability teams.

Contact us to discuss your requirements - we'd love to hear how we can help.

The courses you need

Not seeing the ideal course? Our course schedule is driven by demand. If your chosen course is not scheduled, or there’s a topic, date or location you’d like to see,. please let us know.

Stay updated

To stay up to date with news on our latest courses, topics, webinars and free in person events sign up to our newsletter using the button below.

Bring this course in-house

The courses you need

Stay updated

VantagePoint Training attendee

HSS Hire - attendee

Chinonso Nwagbara

Five day course - attendee

VantagePoint Training attendee

CIIPA - attendee

"Very professional and efficient service - kept to allocated timings and audio/visual was very smooth."

VantagePoint Training attendee

EUMETSAT - attendee

Trusted by

.svg)