IPSAS five-day comprehensive workshop

Build deep IPSAS expertise and confidently apply accrual-based standards in the public sector

This intensive five-day course provides a comprehensive exploration of International Public Sector Accounting Standards (IPSAS) under the accrual basis. Tailored for public sector professionals, it equips participants with a deep understanding of IPSAS principles and standards. Through practical insights and real-world examples, attendees will develop the skills to prepare, interpret and apply IPSAS-compliant financial statements, improving public sector accounting and financial reporting practices.

£4750*

*excludes applicable sales tax

Learning objectives

At the end of this course, participants will be able to:

- Understand and confidently apply accrual-basis IPSAS requirements to the financial statements, including accounting policies and disclosures which will help improve the credibility of the organisation

- Implement the IPSAS recognition and measurement rules for assets, liabilities, revenues and expenses while bringing consistency and transparency to the reported information in the financial statements, which will lead to better resource allocation decisions

- Learn the requirements for presentation and related disclosures to improve the comparability of IPSAS financial statements

- Plan for issues that arise when transitioning to the accrual basis of accounting

- Identify transitional provisions in IPSAS standards

- Become better IPSAS practitioners and increase planning opportunities through awareness of likely future IPSAS changes

- Find the sources of IPSAS guidance that are available.

What's included?

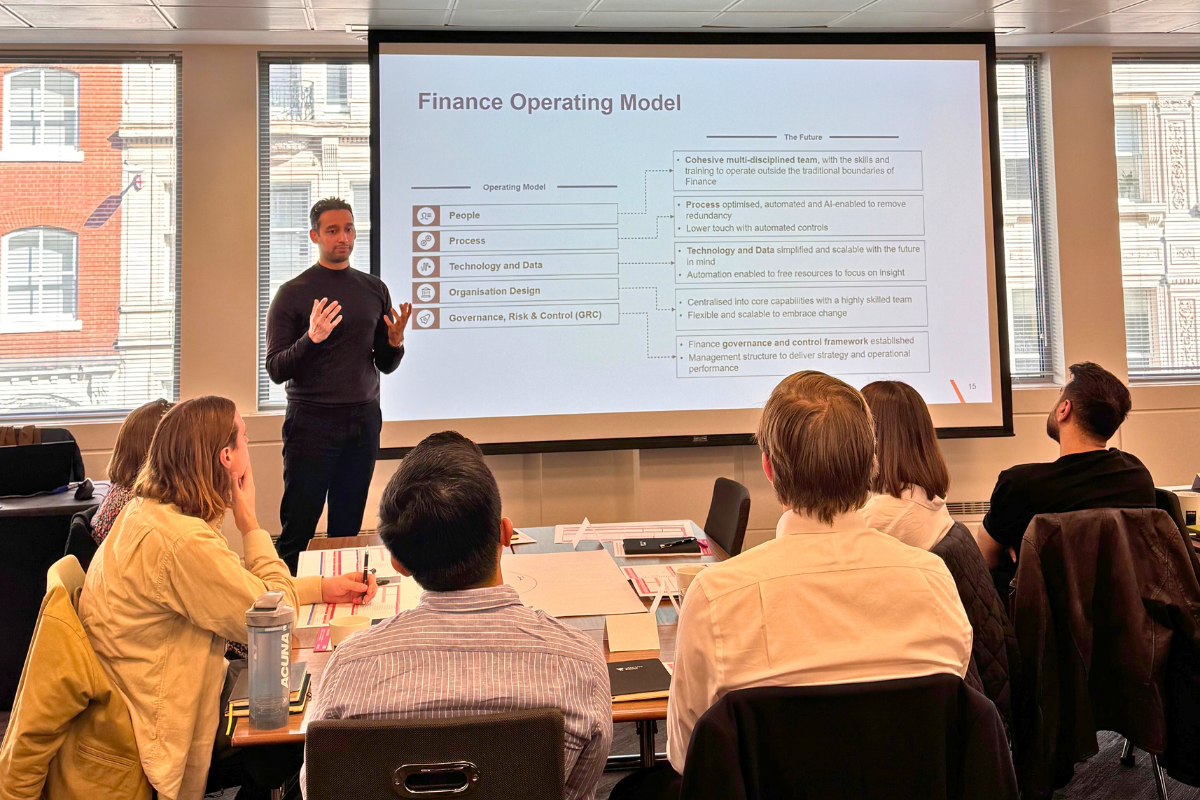

- Five days of classroom tuition presented by our expert senior instructors

- A hosted dinner on one evening of your course

- VantagePoint guest speaker presentations and technology demonstrations

- Fully electronic course materials (including case studies, illustrations and examples) for you to keep

- Interactive materials and exercises so you can put your new knowledge into practice straight away

- Collaborative learning and discussion with fellow attendees

- NASBA approved CPD/CPE credits.

Who should attend?

- Finance and accounting managers of public sector entities considering adoption of IPSAS

- Government officials and project managers responsible for IPSAS transition

- Accountants and finance staff of public sector entities and similar agencies (e.g. UN) in the process of adopting IPSAS

- Accountants and finance staff moving from private to public sector environments

- Internal auditors of entities who have adopted IPSAS or are in the process of doing so

- Accounting practitioners, consultants and external auditors

- Accounting academics.

What can I expect?

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

- Well-equipped classrooms - all our courses take place in well-located, great quality hotels or event spaces with excellent facilities

- Your very own VantagePoint welcome pack.

Your IPSAS comprehensive workshop in detail

In-depth information about the course

The IPSASs aims to improve the quality of general-purpose financial reporting by public sector entities, leading to better-informed assessments of the resource allocation decisions made by governments, thereby increasing transparency and accountability. The International Public Sector Accounting Standards Board (IPSASB) issues IPSASs and Recommended Practice Guidelines (RPGs) relating to the financial reporting needs of national, regional and local governments, governmental agencies and the constituencies they serve.

This five-day course provides an overview of the most important requirements for preparing financial statements and disclosures under accrual-basis IPSASs. The program has been fully updated to reflect the most recent IPSAS handbook and includes the following key standards effective from 2025 or later: IPSAS 43 leases, IPSAS 44 non-current assets held-for-sale and discontinued operations, IPSAS 45 property, plant and equipment, IPSAS 46 measurement, IPSAS 47 revenue and IPSAS 48 transfer expenses.

Accounting and disclosure requirements are explained in clear, simple language and illustrated with model financial statements along with real-world examples. Application of the various standards is illustrated through short case studies.

In addition to a review of current accrual-basis IPSASs, our specialist instructors provide guidance on transitioning to the accrual-basis. Course delegates also receive up-to-date information on the IPSASB’s work plan, including current exposure drafts and consultation papers.

This program answers questions such as:

- What are the current requirements for the presentation of accrual-basis IPSAS financial statements and related disclosures?

- Where can guidance on IPSASs be found?

- How have the IPSASs recently changed?

- What are the likely future requirements of IPSASs?

- What practical issues commonly arise when implementing IPSASs?

- What are the recommendations for transitioning from the cash to the accrual basis of accounting?

Many IPSASs are based on the International Financial Reporting Standards (IFRSs) issued by the International Accounting Standards Board (IASB). IPSASB adapts IFRS to a public sector context when appropriate. In undertaking that process, the IPSASB attempts, wherever possible, to maintain the accounting treatment of the IFRS unless there is a significant public sector issue which warrants a departure. Other IPSASs have been developed to meet issues specific to the public sector, such as non-exchange transactions.

Introduction to IPSASs

- IPSAS board and due process

- Conceptual framework

IPSAS 1 presentation of financial statements

- Complete set of financial statements

- Structure and minimum content

IPSAS 2 cash flow statements

- Cash and cash equivalents

- Operating, investing and financing activities

IPSAS 3 accounting policies, changes in accounting estimates and errors

IPSAS 14 events after the reporting date

IPSAS 17 property, plant and equipment

- Initial recognition

- Subsequent measurement

- Depreciation

- Infrastructure and heritage assets

IPSAS 45 property, plant and equipment (replaces IPSAS 17 from 2025)

- Changes to infrastructure and heritage assets

- Current value measurement model – current operational value and fair value

IPSAS 46 measurement (mandatory from 2025)

- Measurement bases

- Required disclosures

IPSAS 5 borrowing costs

IPSAS 16 investment property

- Initial recognition

- Subsequent measurement

IPSAS 31 intangible assets

- Initial recognition

- Subsequent measurement

IPSAS 21 and 26 impairment of non-cash-generating assets and impairment of cash-generating assets

- Indicators of impairment

- Recognition and measurement

- Reversals of past impairments

- Disclosure requirements

IPSAS 44 non-current assets held for sale and discontinued operations (mandatory from 2025)

IPSAS 23 revenue from non-exchange transactions

- Recognition and measurement of revenue from taxes and transfers

- Reflecting conditions and restrictions in the financial statements

IPSAS 9 revenue from exchange transactions

IPSAS 47 revenue (replaces IPSAS 9 and IPSAS 23 from 2026)

- Revenue transaction with binding arrangements

- Revenue transaction without binding arrangements

IPSAS 12 inventories

- Inventories held for free distribution or a nominal charge

- General expense recognition principles

IPSAS 48 transfer expenses (mandatory from 2026)

- Transfer expenses transaction with binding arrangements

- Transfer expenses transaction without binding arrangements

IPSAS 19 provisions, contingent liabilities and contingent assets

- Definitions

- Recognition and measurement

- Disclosures

IPSAS 42 social benefits

IPSAS 39 employee benefits

- Short and long-term benefits

- Recognition, measurement of pension obligations

IPSAS 13 Leases

IPSAS 43 (replacing IPSAS 13 from 2025)

- Definition of a lease

- Optional recognition exemptions

- Lessee and lessor financial reporting requirements, including lease modifications

IPSAS 32 service concession arrangements

IPSAS 4 the effects of changes in foreign exchange rates

- Foreign currency transactions

- Foreign operations

IPSAS 28 financial instruments presentation

IPSAS 41 financial instruments

IPSAS 30 financial instruments: disclosures

IPSAS 35 consolidated financial statements - accounting for controlled entities

- Consolidation boundaries and concepts of public sector control

- Consolidation requirements

IPSAS 36 Accounting for investments in associates and joint ventures

- Equity method of accounting

- Cost method requirements

IPSAS 37 accounting for joint arrangements

- Distinguishing joint ventures from joint operations

- Equity and joint operations accounting

IPSAS 40 public sector combinations

- Amalgamation vs acquisition accounting

IPSAS 18 segment reporting

- Distinguishable activities

IPSAS 20 related party disclosures

- Identification of related parties

- Disclosure requirements

IPSAS 24 presentation of budget information in financial statements

- Required disclosures

- Comparison of budget and actual amounts

- Material differences

Overview of other new standards

- IPSAS 49 retirement benefit plans (mandatory from 2026)

- IPSAS 50 exploration for and evaluation of mineral resources (mandatory from 2027)

IPSAS 33 first-time adoption of accrual basis IPSASs recommended practice guidelines

- RPG 1 reporting on the long-term sustainability of an entity’s finances

- RPG 2 financial statement discussion and analysis

- RPG 3 reporting service performance information

- Reporting sustainability program information

Public sector sustainability reporting

- Climate-related disclosures project

- Climate change: relevant IPSASB guidance

- Group live instruction with a focus on interactive participation, ensuring a collaborative learning environment.

- Comprehensive review of the rationale, objectives and scope of IPSAS, providing a solid foundation for application in the public sector.

- Clear and simple explanation of IPSAS requirements, making complex principles easily accessible for participants.

- Real-world case studies and examples to illustrate the practical application of IPSAS, helping participants directly relate theory to their organisational contexts.

- Hands-on exercises designed to reinforce learning and provide practical experience in preparing and interpreting IPSAS-compliant financial statements.

- In line with VantagePoint’s sustainability commitment, all course materials are provided in soft copy, with printed handouts limited to in-class exercises only.

This course provides 40 hours of CPE/CPD credits.

VantagePoint Training is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

Bring this course in-house

Do you need to upskill your team? We specialise in the design and delivery of bespoke events for finance and sustainability teams.

Contact us to discuss your requirements - we'd love to hear how we can help.

The courses you need

Not seeing the ideal course? Our course schedule is driven by demand. If your chosen course is not scheduled, or there’s a topic, date or location you’d like to see,. please let us know.

Stay updated

To stay up to date with news on our latest courses, topics, webinars and free in person events sign up to our newsletter using the button below.

Bring this course in-house

The courses you need

Stay updated

VantagePoint Training attendee

HSS Hire - attendee

Chinonso Nwagbara

Five day course - attendee

VantagePoint Training attendee

CIIPA - attendee

"Very professional and efficient service - kept to allocated timings and audio/visual was very smooth."

VantagePoint Training attendee

EUMETSAT - attendee

Trusted by

.svg)