IFRS five-day comprehensive workshop

Our most popular IFRS training event!

This detailed and highly interactive five-day course provides a comprehensive overview of the key technical issues involved in preparing IFRS-compliant financial statements. Alongside deep dives into major IFRS standards, the course also introduces the application of disclosure requirements under the new IFRS Sustainability Disclosure Standards, giving participants a well-rounded and current perspective on reporting today.

£4750*

*excludes applicable sales tax

Learning objectives

At the end of this course, participants will be able to:

- Apply the requirements of IFRSs to prepare compliant financial statements, including determining accounting policies and drafting required disclosures

- Apply IFRS fair value measurement and impairment testing requirements

- Learn how to recognise and measure liabilities in accordance with relevant IFRSs

- Implement the standards dealing with business combinations and the treatment of interests in other entities including associates and joint ventures

- Develop methods of presenting information clearly in IFRS financial statements.

- Review and apply the requirements of IFRS Sustainability Disclosure Standards - IFRS S1 and S2.

What's included?

- Five days of classroom tuition presented by our expert senior instructors

- Fully electronic course materials (including case studies, illustrations and examples) for you to keep

- Interactive materials and exercises so you can put your new knowledge into practice straight away

- NASBA approved CPD/CPE credits.

Who should attend?

-

Accountants in finance and reporting teams who prepare IFRS financial statements

-

External and internal auditors

-

Financial and credit analysts who review financial statements.

What can I expect?

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

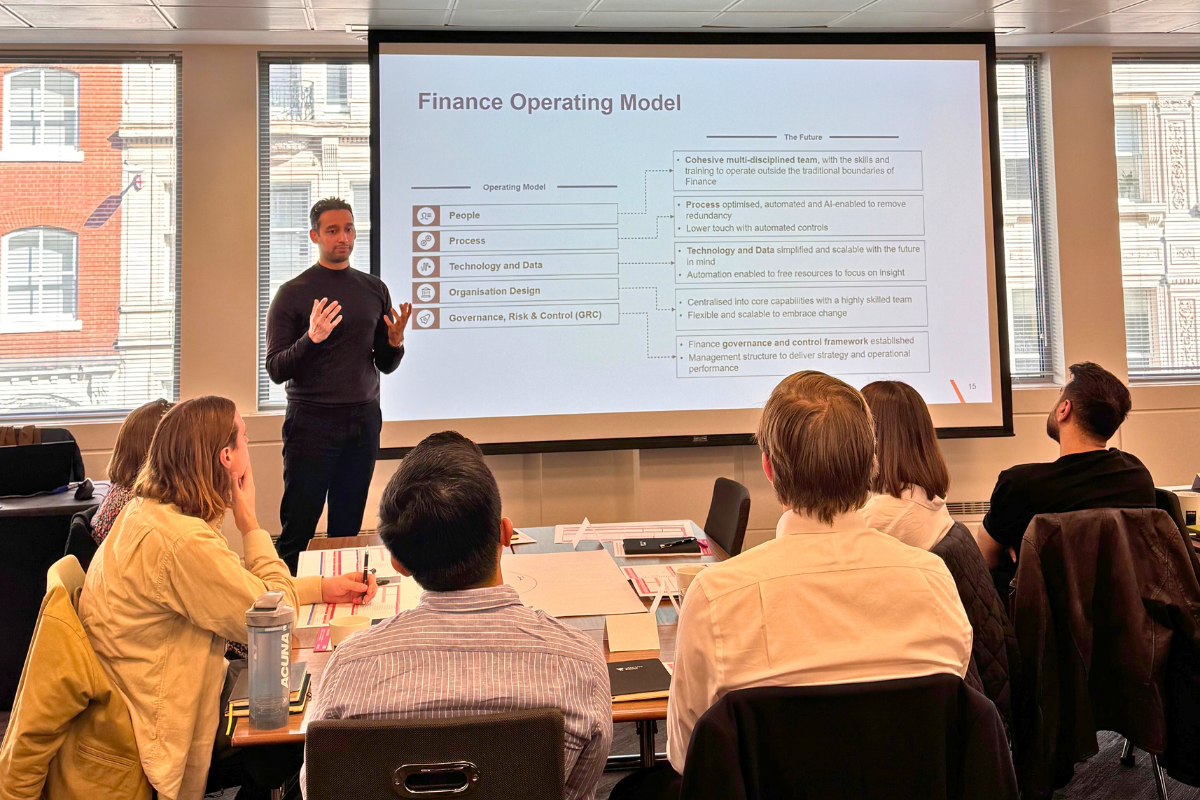

- Well-equipped classrooms - all our courses take place in well-located, great quality hotels or event spaces with excellent facilities

- Your very own VantagePoint welcome pack.

Your IFRS comprehensive workshop in detail

In-depth information about the course

International Financial Reporting Standards (IFRSs) are the world’s most widely applied accounting standards. More than 150 countries now require or permit the use of IFRSs.

This five-day course provides a rigorous and detailed overview of all major technical IFRS requirements and includes illustrative financial statements, case studies, examples and interactive participation from the delegates.

This program answers questions such as:

- How should IFRS recognition and measurement requirements be applied in practice?

- What are the disclosure requirements of IFRSs and how can preparers ensure that they meet users’ needs?

- How do companies apply requirements of the IFRS Sustainability Disclosure Standards

What can you expect from this event?

- Five days of classroom tuition presented by our most senior instructors

- A VantagePoint welcome pack

- A hosted VantagePoint dinner on one evening of your course

- VantagePoint guest speaker presentations and technology demonstrations

- Collaborative learning and discussion with fellow attendees

Introduction to IFRSs

IFRS standard setting – the bodies and due process

Conceptual framework

Fair value measurement (IFRS 13)

Content of IFRS financial statements

Presentation of financial statements (IAS 1)

Statement of cash flows (IAS 7)

Accounting policies, changes in accounting estimates and errors (IAS 8)

Discontinued operations (IFRS 5)

Events after the reporting period (IAS 10)

Operating segments (IFRS 8)

Interim financial reporting (IAS 34)

Assets

Inventories (IAS 2)

Property, plant and equipment (IAS 16)

Borrowing costs (IAS 23)

Intangible assets (IAS 38)

Investment property (IAS 40)

Impairment of assets (IAS 36)

Liabilities

Leases (IFRS 16)

Employee benefits (IAS 19)

Provisions, contingent liabilities and contingent assets (IAS 37)

Financial instruments

Presentation (IAS 32)

Recognition and measurement (IFRS 9)

Disclosures (IFRS 7)

Income taxes

Income taxes (IAS 12)

Revenue

Revenue from contracts with customers (IFRS 15)

Government grants and assistance

Accounting for government grants and disclosure of government assistance (IAS 20)

Foreign currency issues

Effects of changes in foreign exchange rates (IAS 21)

Business combinations and interests in other entities

Business combinations (IFRS 3)

Consolidated financial statements (IFRS 10)

Investments in associates and joint ventures (IAS 28)

Joint arrangements (IFRS 11)

IFRS Sustainability Disclosure Standards

Overview of the ISSB and IFRS Sustainability Disclosure StandardsGeneral Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1)

Climate-related Disclosures (IFRS S2)

Implementation challenges and actions for smooth adoption of the Standards

Interaction with other frameworks: ESRS, GRI

Expectations of key regulators on reporting the impact of climate change in IFRS financial statements

- Group live instruction complemented with clear, practical examples to ensure understanding of key IFRS concepts and sustainability disclosures.

- Detailed explanation of IFRS technical accounting requirements and sustainability disclosure standards, presented in accessible and straightforward language.

- Case studies and real-world examples to demonstrate the practical application of IFRS standards in diverse business contexts.

- Interactive participation encouraged, fostering group discussions, Q&A sessions, and knowledge-sharing among participants to reinforce learning.

- In line with VantagePoint’s sustainability commitment, all course materials are provided in soft copy, with printed handouts limited to in-class exercises only.

This course provides you with 40 hours of CPE/CPD credits.

VantagePoint Training is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org. For information regarding administrative policies such as our complaint policy and refund policy, please contact us at training@vantagepoint.consulting.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

Bring this course in-house

Do you need to upskill your team? We specialise in the design and delivery of bespoke events for finance and sustainability teams.

Contact us to discuss your requirements - we'd love to hear how we can help.

The courses you need

Not seeing the ideal course? Our course schedule is driven by demand. If your course is not scheduled, or there’s a topic, date or location you’d like to see please let us know.

Stay updated

To stay up to date with news on our latest courses, topics, webinars and free in person events sign up to our newsletter using the button below.

Bring this course in-house

The courses you need

Stay updated

VantagePoint Training attendee

HSS Hire - attendee

Chinonso Nwagbara

Five day course - attendee

VantagePoint Training attendee

CIIPA - attendee

"Very professional and efficient service - kept to allocated timings and audio/visual was very smooth."

VantagePoint Training attendee

EUMETSAT - attendee

Trusted by

.svg)